CELEBRATING 60 YEARS OF DICON: AN OVERVIEW

The Defence Industries Corporation of Nigeria (DICON), established in 1964 by an Act of Parliament in partnership with a German firm, recently marked its 60th anniversary as a pivotal entity in Nigeria’s defence landscape.

Originally tasked with producing arms and ammunition for the Nigerian Armed Forces, DICON has evolved amidst national security demands, from its critical role during the 1967-1970 Civil War, where it tripled production of rifles, submachine guns, and ammunition, to recent efforts in fostering self-reliance in defence technology.

READ ALSO: DICON and Beyond: Charting Africa’s Indigenous Defence Manufacturing Journey

This provides a lens to examine Nigeria’s defence industry, highlighting its technological advancements while addressing persistent challenges in a context of escalating security threats such as insurgency and banditry.

DICON’s journey began with the establishment of an ordinance factory in Kaduna, aimed at reducing dependence on foreign arms imports through local manufacturing. During the Civil War, it demonstrated remarkable capacity by supplying essential materials, representing national self-reliance.

Post-war, however, production lines largely went silent due to a lack of government patronage, leading DICON to pivot toward civilian products like furniture and water supply equipment.

Interestingly, the 2023 DICON Act marked a turning point, expanding its mandate to include advanced research via the Defence Industry Technology, Research and Development Institute (DITRDI) and enabling partnerships for modern technologies.

Over six decades, DICON has transitioned from basic armament production to aspiring for global relevance, though it has lagged behind peers like Brazil’s Embraer and Malaysia’s SME Ordnance due to inconsistent support.

CURRENT SYSTEMS AND TECHNOLOGICAL CAPABILITIES

Today, DICON’s systems encompass small arms manufacturing, ammunition production, and emerging technologies such as the BAT A-1 Specialised Assault Rifle, Ezugwu Mine-Resistant Ambush Protected (MRAP) vehicles, and unmanned aerial and ground systems.

Recent initiatives include a $1 billion partnership with India for 40% self-sufficiency in defence equipment within three years, and MoUs with entities like NASENI for ammunition factories and international firms for drones and satellite lasers.

The corporation is also investing in robotics, artificial intelligence, and lithium-based resources from Nasarawa State to power advanced defence applications. Under the DICON Evolution Strategy, efforts focus on integrating AI for military decision-making and autonomous drones for surveillance, showcased during the 60th anniversary’s Defence Innovation Challenge.

STRENGTHS: INDIGENOUS PRODUCTION AND STRATEGIC PARTNERSHIPS

One of DICON’s core strengths lies in its potential for indigenous production, which reduces foreign exchange expenditure and enhances national security by ensuring timely access to military hardware.

Strategic partnerships, including joint ventures worth billions with firms like SP Offshore, PGZ from Poland, and Saudi entities, have introduced advanced technologies and facilitated knowledge transfer to Nigerian engineers. The corporation’s historical resilience, evident in its Civil War contributions, combined with recent policy support like the “Nigeria First” procurement measure, bolsters local manufacturing and job creation.

Additionally, DICON’s role in fostering regional collaboration through events like the African Defence Industries Conference positions Nigeria as a leader in Africa’s defence technology, attracting investments and promoting innovations under the AfCFTA. These alliances not only modernise operations but also stimulate ancillary industries in metallurgy and engineering.

NOTABLE ACHIEVEMENTS IN SELF-RELIANCE

DICON has achieved significant milestones in self-reliance, including the local assembly of weapons, production of 7.62mm rounds, and development of specialised vehicles like the Ezugwu MRAP. The 2023 DICON Act has enabled a $2 billion joint venture and MoUs for environmental sustainability initiatives, such as tree planting to combat climate change, alongside defence advancements.

The launch of the Defence Innovation Challenge during the 60th anniversary engaged youth in creating cutting-edge technologies, while partnerships have led to staff training abroad and raw material sourcing improvements. Economically, these efforts save costs on imports, create employment, and position DICON for exports, with the Roadmap 2030 aiming for self-funding and international market penetration.

Such achievements underscore DICON’s transformation into a hub for defence innovation in Africa.

WEAKNESSES: FUNDING AND OPERATIONAL CHALLENGES

Despite its potential, DICON’s weaknesses are pronounced, primarily stemming from chronic underfunding and infrastructural decay, which have rendered production lines largely non-operational post-Civil War.

The absence of a robust military-industrial complex has led to over-reliance on imports, escalating costs and delaying responses to security threats like insurgency. Operational inefficiencies, including obsolete equipment and inadequate capital expenditure, evident in the 2018 budget, where only 27% was allocated to capital projects have hindered technological upgrades.

PERSISTENT ISSUES: CORRUPTION AND RESOURCE SHORTAGES

Corruption remains a systemic weakness in Nigeria’s defence sector, including DICON, with procurement processes shrouded in secrecy and exempted from public oversight, leading to very high risks as per the 2020 Government Defence Integrity Index.

Compared to South Africa’s defence industry, DICON’s progress has been derailed by corruption and funding gaps, lacking indigenous technological development and infrastructure. These issues contribute to broader economic underdevelopment and reduced employment opportunities in the defence sector.

PATHWAYS TO IMPROVEMENT: REFORMS AND INVESTMENTS

To enhance DICON, comprehensive reforms are essential, starting with increased funding and oversight to combat corruption, including updating audit laws and enforcing transparent procurement.

Investments in human capital through training programs, modern facilities, and integrating military-civilian R&D could boost innovation and address skill gaps. Policy incentives like a Defence Industry Fund for low-interest loans, tax breaks, and mandatory local procurement, similar to the oil sector’s Local Content Act, would foster partnerships and self-sufficiency. Ultimately, collective action from the government, private sector, and international partners, aligned with the 2030 Roadmap, can position DICON as a global player in defence technology.

King Richard Igimoh, Group Editor ALO

King Richard Igimoh, Group Editor African Leadership Organisation is an award-winning journalist, editor, and publisher with over two decades of expertise in political, defence, and international affairs reporting. As Group Editor of the African Leadership Organisation—publishers of African Leadership Magazine, African Defence & Security Magazine, and Africa Projects Magazine—he delivers incisive coverage that amplifies Africa’s voice in global security, policy, and leadership discourse. He provides frontline editorial coverage of high-profile international events, including the ALM Persons of the Year, the African Summit, and the African Business and Leadership Awards (ABLA) in London, as well as the International Forum for African and Caribbean Leadership (IFAL) in New York City during the United Nations General Assembly.

Recent Posts

Categories

- Air & Aerospace17

- Border Security15

- Civil Security6

- Civil Wars4

- Crisis5

- Cyber Security8

- Defense24

- Diplomacy19

- Entrepreneurship1

- Events5

- Global Security Watch6

- Industry8

- Land & Army9

- Leadership & Training5

- Military Aviation7

- Military History27

- Military Speeches1

- More1

- Naval & Maritime9

- Policies1

- Resources2

- Security12

- Special Forces2

- Systems And Technology9

- Tech6

- Uncategorized6

- UNSC1

- Veterans7

- Women in Defence9

Related Articles

DEFENCE MANUFACTURING CLUSTERS EMERGING IN AFRICA

Africa’s defence manufacturing sector is increasingly organized around specialized industrial clusters, reflecting...

ByKing Richard Igimoh, Group Editor ALOFebruary 3, 2026THE ALGERIAN WAR OF INDEPENDENCE: TACTICAL LESSONS

The Algerian War of Independence (1954–1962) remains one of the most instructive...

ByKing Richard Igimoh, Group Editor ALOJanuary 23, 2026THE RISE OF AFRICAN AIRBORNE EARLY WARNING SYSTEMS

As security threats across Africa grow more complex, a quiet transformation is...

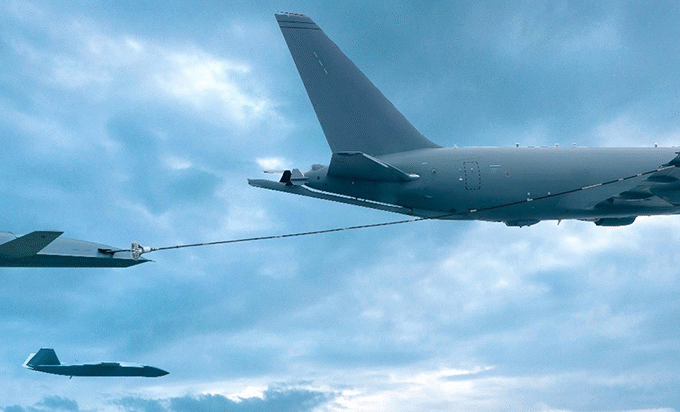

ByKing Richard Igimoh, Group Editor ALOJanuary 14, 2026AERIAL REFUELLING IN AFRICA: WHO HAS THE CAPABILITY?

Aerial refuelling transferring fuel between aircraft in mid-flight is one of modern...

ByKing Richard Igimoh, Group Editor ALOOctober 21, 2025