Biometric Borders: Evaluating National Rollouts Across Africa

Africa’s border management systems have travelled a long road — from the colonial-era reliance on paper documents and manual checks to the gradual introduction of machine-readable passports in the 1990s. Before the 21st century, most African borders were characterised by long queues, overworked immigration officers, and limited ability to detect forged documents or track repeat offenders.

The global shift towards biometric identification — using fingerprints, facial recognition, and iris scans — gained momentum after the September 11, 2001 attacks, when the international security community began to prioritise advanced identity verification. The International Civil Aviation Organisation (ICAO) pushed for electronic passports (e-passports) embedded with biometric chips, and African states slowly began to follow suit.

In the early 2000s, South Africa, Morocco, and Kenya were among the first African countries to experiment with biometric systems for immigration control. By the 2010s, regional blocs such as the Economic Community of West African States (ECOWAS) began rolling out biometric passports for free movement within the bloc, setting the stage for broader adoption.

The Strategic Imperative for Biometrics in Africa

The rationale for biometric borders in Africa extends beyond migration management — it is about national security, economic stability, and global integration.

- Security: The rise of transnational terrorism, organised crime, and irregular migration has pushed governments to adopt tools that can reliably confirm identities, even in cases where individuals use false documents.

- Economic Growth: Safer borders encourage tourism, foreign investment, and legitimate cross-border trade.

- Compliance with International Standards: To maintain visa-free or visa-on-arrival agreements with other nations, African states must demonstrate strong identity management systems.

Regional Rollouts: Successes and Stumbling Blocks

West Africa: The ECOWAS Experience

ECOWAS introduced biometric passports in 2014, aiming for seamless movement within its 15 member states. While Nigeria, Ghana, and Senegal have successfully transitioned, smaller economies have faced challenges with the cost of infrastructure, staff training, and system maintenance.

East Africa: Kenya’s Huduma Namba and Border Modernisation

Kenya’s integrated biometric ID system, Huduma Namba, has been linked to immigration controls, enabling faster verification at airports and land borders. However, legal challenges over data privacy and inclusivity have slowed its full integration.

Southern Africa: South Africa’s Smart Border Vision

South Africa’s Enhanced Movement Control System (EMCS) combines biometrics with real-time watchlist checks, reducing border queue times. The government has also trialled automated e-gates at OR Tambo International Airport.

North Africa: Morocco’s Digital Entry Points

Morocco has invested heavily in biometric entry systems at both tourist hubs and sensitive border crossings, integrating them with police databases to detect persons of interest.

Challenges in Implementing Biometric Borders

- High Initial Costs

Advanced biometric systems require investment in hardware, software, and data storage facilities, often costing millions of dollars per rollout. - Data Privacy and Legal Frameworks

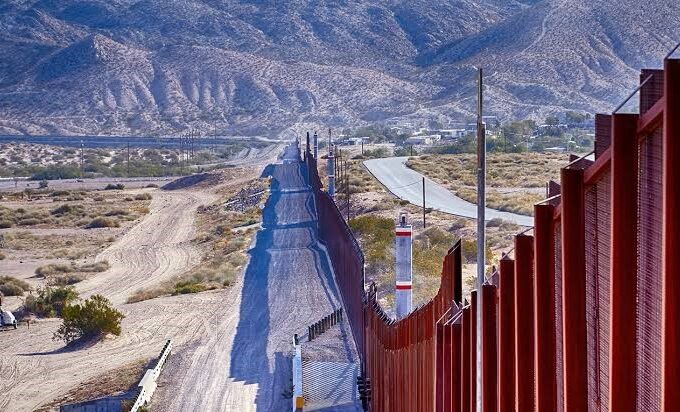

Many African countries lack comprehensive data protection laws, raising concerns about how biometric data is stored, shared, and secured. - Interoperability Issues

Differing systems between neighbouring states hinder cross-border verification, especially in regions with porous land borders. - Maintenance and Technical Capacity

Equipment breakdowns, lack of trained technicians, and software licensing costs can derail projects.

Case Study: The Nigeria Biometric Border Management System (NBMS)

Nigeria’s NBMS, launched in 2022, integrates biometric enrolment at air, land, and sea borders with the National Identity Database. Within the first year, the system flagged hundreds of individuals on INTERPOL watchlists. However, delays in upgrading land border posts have meant that smuggling and irregular migration remain significant challenges.

The Role of Partnerships

International partnerships have been critical in driving biometric adoption:

- International Organisation for Migration (IOM) has supported capacity building and system deployment in countries like Uganda and Sudan.

- European Union funding has helped West African states upgrade border posts to meet Schengen-aligned security standards.

- Private sector tech firms, including African startups, are increasingly competing with global vendors for government biometric contracts.

The Road Ahead

The next phase for African biometric borders will focus on:

- Cross-Border Data Sharing Agreements to allow real-time verification between countries.

- Mobile Biometric Kits for remote and rural border points.

- Public Awareness Campaigns to build citizen trust in data handling.

For biometric borders to deliver their full promise, African governments must balance security imperatives with human rights safeguards, ensuring systems are both effective and equitable.

Biometric border management is reshaping Africa’s entry and exit points into smarter, more secure gateways. Yet, its success will hinge not only on technology but on governance, regional cooperation, and public trust. In a continent where borders can be both lifelines and flashpoints, the biometric revolution is as much a political project as it is a technological one.

King Richard Igimoh, Group Editor ALO

King Richard Igimoh, Group Editor African Leadership Organisation is an award-winning journalist, editor, and publisher with over two decades of expertise in political, defence, and international affairs reporting. As Group Editor of the African Leadership Organisation—publishers of African Leadership Magazine, African Defence & Security Magazine, and Africa Projects Magazine—he delivers incisive coverage that amplifies Africa’s voice in global security, policy, and leadership discourse. He provides frontline editorial coverage of high-profile international events, including the ALM Persons of the Year, the African Summit, and the African Business and Leadership Awards (ABLA) in London, as well as the International Forum for African and Caribbean Leadership (IFAL) in New York City during the United Nations General Assembly.

Recent Posts

Categories

- Air & Aerospace17

- Border Security15

- Civil Security6

- Civil Wars4

- Crisis5

- Cyber Security8

- Defense24

- Diplomacy19

- Entrepreneurship1

- Events5

- Global Security Watch6

- Industry8

- Land & Army9

- Leadership & Training5

- Military Aviation7

- Military History27

- Military Speeches1

- More1

- Naval & Maritime9

- Policies1

- Resources2

- Security12

- Special Forces2

- Systems And Technology9

- Tech6

- Uncategorized6

- UNSC1

- Veterans7

- Women in Defence9

Related Articles

THE CASE FOR CONTINENTAL BORDER SECURITY STANDARDS

Africa’s borders remain both an opportunity and a liability. They enable trade,...

ByKing Richard Igimoh, Group Editor ALODecember 27, 2025BORDER SECURITY – LESSONS FROM ECOWAS BORDER MANAGEMENT STRATEGIES

Since its founding in 1975, the Economic Community of West African States...

ByKing Richard Igimoh, Group Editor ALONovember 21, 2025COMMUNITY INTELLIGENCE AT BORDERS: SUCCESSES AND FAILURES

Border security increasingly relies on community intelligence the collection and use of...

ByKing Richard Igimoh, Group Editor ALOOctober 6, 2025REFUGEE MOVEMENTS AND BORDER FORCE DILEMMAS

In today’s world of conflict, climate change, and widening economic divides, refugee...

ByKing Richard Igimoh, Group Editor ALOSeptember 24, 2025