DEFENCE MANUFACTURING CLUSTERS EMERGING IN AFRICA

Africa’s defence manufacturing sector is increasingly organized around specialized industrial clusters, reflecting a strategic effort to strengthen local production capacity amid persistent security pressures and fragile global supply chains. Rather than relying solely on fragmented national factories, several countries are concentrating arms production, maintenance, repair and overhaul (MRO), and defence technology development within designated industrial zones. South Africa, Egypt, Nigeria, and Algeria remain the most established players, while Morocco, Ethiopia, Kenya, and others are developing more targeted hubs supported by international partnerships. Together, these initiatives signal a gradual shift toward indigenous capability, industrial coordination, and reduced dependence on external suppliers.

South Africa remains the continent’s most developed defence manufacturing centre. The Tshwane (Pretoria) region hosts a dense concentration of aerospace and defence firms, accounting for a large share of the country’s production capacity and technical expertise. Anchored by companies such as Denel, Paramount Group, and Reutech, alongside state-owned and private suppliers, the cluster produces armoured vehicles, artillery systems, avionics, sensors, and electronic warfare equipment. Although constrained by declining defence budgets and restructuring within state-owned firms, South Africa retains a vertically integrated value chain and export-oriented experience unmatched elsewhere on the continent. Industry events such as the Africa Aerospace and Defence exhibition continue to reinforce its role as a continental reference point.

Related Articles: Africa’s Defence Industry: Confronting Challenges, Unlocking Strategic Potential

North Africa hosts the most expansive state-led defence industries. Egypt operates one of Africa’s broadest military-industrial bases through organizations affiliated with the Ministry of Military Production and the Arab Organization for Industrialization. These entities manufacture small arms, ammunition, armoured vehicles, aircraft components, naval platforms, and electronics, with production concentrated around major industrial zones. While not formally branded as a single cluster, this geographic and institutional concentration enables economies of scale, domestic supply assurance, and limited exports. Algeria has similarly expanded local production of small arms, vehicles, and licensed systems, prioritizing strategic autonomy and supply security in a volatile regional environment.

In West Africa, Nigeria is working to consolidate its defence industrial base around the Defence Industries Corporation of Nigeria (DICON) in Kaduna. Historically limited to small arms and ammunition, DICON has expanded its ambitions through public-private partnerships and licensed production arrangements. The unveiling of locally assembled armoured vehicles and renewed plans for ammunition manufacturing reflect efforts to address chronic equipment shortages linked to counter-insurgency operations. While Nigeria’s ecosystem remains less integrated than those in North or Southern Africa, the focus on clustering production, training, and oversight marks a structural shift toward sustainability.

Morocco has emerged as a notable new entrant, using targeted industrial zones to attract foreign defence manufacturers. The country has positioned itself as a platform for joint production and technology transfer, drawing interest from companies in the United States, Europe, and Asia. India’s Tata Advanced Systems has established a defence production facility in Morocco, while other firms have explored opportunities linked to aerospace and electronics. By concentrating defence activity within designated zones, Morocco aims to accelerate capability development while leveraging its proximity to European markets and established industrial base.

Beyond these major players, several countries are pursuing narrower but strategically important capabilities. Ethiopia and Kenya have invested in small arms production and aviation MRO, while Rwanda has promoted itself as a regional maintenance and logistics hub. Ghana has taken initial steps toward localized defence manufacturing focused on basic equipment and sustainment. These efforts are typically facility-based rather than fully developed clusters, but they reflect growing recognition of the economic and security value of domestic defence capacity.

The expansion of defence manufacturing clusters offers tangible benefits. Concentrated production improves supply chain resilience, shortens procurement timelines, and supports technology localization. Defence industries generate skilled employment, stimulate supporting sectors such as metallurgy and electronics, and provide export opportunities that can offset import costs. Partnerships with firms from Turkey, the United Arab Emirates, China, India, and the United States have played a central role in accelerating capability development through licensing, joint ventures, and training.

However, challenges remain significant. Limited funding, uneven regulatory frameworks, skills shortages, and dependence on foreign technology constrain progress. Fragmented national approaches also limit economies of scale. Analysts increasingly point to the need for stronger coordination through regional mechanisms, clearer industrial policies, sustained investment in research and development, and balanced public-private partnerships. If these conditions are met, Africa’s emerging defence manufacturing clusters could evolve from isolated projects into a more coherent industrial base, strengthening both security autonomy and economic resilience.

King Richard Igimoh, Group Editor ALO

King Richard Igimoh, Group Editor African Leadership Organisation is an award-winning journalist, editor, and publisher with over two decades of expertise in political, defence, and international affairs reporting. As Group Editor of the African Leadership Organisation—publishers of African Leadership Magazine, African Defence & Security Magazine, and Africa Projects Magazine—he delivers incisive coverage that amplifies Africa’s voice in global security, policy, and leadership discourse. He provides frontline editorial coverage of high-profile international events, including the ALM Persons of the Year, the African Summit, and the African Business and Leadership Awards (ABLA) in London, as well as the International Forum for African and Caribbean Leadership (IFAL) in New York City during the United Nations General Assembly.

Recent Posts

Categories

- Air & Aerospace17

- Border Security15

- Civil Security6

- Civil Wars4

- Crisis5

- Cyber Security8

- Defense24

- Diplomacy19

- Entrepreneurship1

- Events5

- Global Security Watch6

- Industry8

- Land & Army9

- Leadership & Training5

- Military Aviation7

- Military History27

- Military Speeches1

- More1

- Naval & Maritime9

- Policies1

- Resources2

- Security12

- Special Forces2

- Systems And Technology9

- Tech6

- Uncategorized6

- UNSC1

- Veterans7

- Women in Defence9

Related Articles

THE ALGERIAN WAR OF INDEPENDENCE: TACTICAL LESSONS

The Algerian War of Independence (1954–1962) remains one of the most instructive...

ByKing Richard Igimoh, Group Editor ALOJanuary 23, 2026THE RISE OF AFRICAN AIRBORNE EARLY WARNING SYSTEMS

As security threats across Africa grow more complex, a quiet transformation is...

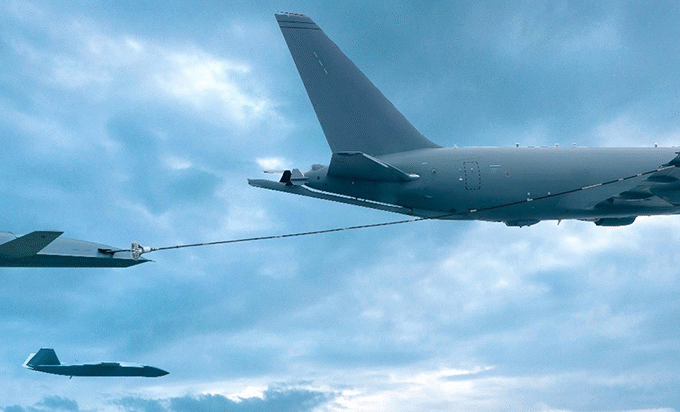

ByKing Richard Igimoh, Group Editor ALOJanuary 14, 2026AERIAL REFUELLING IN AFRICA: WHO HAS THE CAPABILITY?

Aerial refuelling transferring fuel between aircraft in mid-flight is one of modern...

ByKing Richard Igimoh, Group Editor ALOOctober 21, 2025ECOWAS MILITARY INTERVENTION IN NIGER: A TURNING POINT?

The coup d’état in Niger on July 26, 2023, marked a seismic...

ByKing Richard Igimoh, Group Editor ALOOctober 7, 2025

Leave a comment