THE PUSH FOR MADE-IN-AFRICA AMMUNITION AND SMALL ARMS

For decades, Africa’s security has rested on foreign supply lines. More than 90% of the continent’s small arms and ammunition come from outside mainly Russia, China, and Western nations. That reliance has left African militaries vulnerable to global supply disruptions, sanctions, and shifting alliances. Now, a growing movement across the continent aims to change that.

Under the African Union’s Agenda 2063, which champions self-reliance in defense and technology, countries are investing heavily in homegrown arms manufacturing. The goal: reduce the continent’s $2 billion annual arms import bill and strengthen sovereignty in a volatile global market.

Related Article: GLOBAL SECURITY WATCH – LESSONS FROM NATO FOR AFRICAN REGIONAL DEFENCE COOPERATION

SOUTH AFRICA’S HEAD START

South Africa has long been the continent’s benchmark for domestic defence production. State-backed firms like Denel Dynamics and Rheinmetall Denel Munition have produced 5.56mm and 7.62mm NATO-standard ammunition for decades, exporting to over 30 countries while supplying the South African National Defence Force.

Recent partnerships, such as Denel’s 2023 deal with Saudi Arabia to co-produce ammunition, signal renewed momentum. These ventures not only meet local military needs but also create thousands of skilled jobs and generate foreign exchange. Crucially, they shield South Africa from the kind of international embargoes that crippled its defence sector during apartheid.

NIGERIA’S REAWAKENING

Nigeria, Africa’s largest economy, is attempting to replicate that model. The Defence Industries Corporation of Nigeria (DICON) founded in 1964 but long dormant has been revived under a $2 billion modernization plan announced by President Bola Tinubu in 2023.

In collaboration with Turkey’s Mechanical and Chemical Industry Corporation (MKE), DICON is developing the capacity to produce AK-47 variants, 9mm pistols, and assorted ammunition. The initiative aims to supply Nigeria’s counter-insurgency operations against Boko Haram, which have frequently been hampered by ammunition shortages. By 2025, the government hopes to achieve 70% local content in small-arms production, part of a broader strategy to diversify the economy beyond oil.

ETHIOPIA AND THE NORTH AFRICAN BLOC

Ethiopia’s Gafat Armament Industry accelerated output during the 2020–2022 Tigray conflict, manufacturing rifles and ammunition to sustain the war effort. With Chinese technical support, the country now produces 7.62mm rounds and plans to expand into mortar shells cutting its dependence on imports from neighbours like Sudan and Eritrea.

In North Africa, similar momentum is visible. Algeria operates large Beretta-licensed pistol factories, while Egypt’s Arab Organization for Industrialization produces M16-style rifles under U.S. licenses. These countries, leveraging energy revenues and international partnerships, are building a regional network of defence industries that could one day support continental self-sufficiency.

CHALLENGES AND INNOVATION

Yet the path to independence is steep. Many African facilities still rely on aging Soviet-era machinery, leading to inconsistent quality. Access to precision tooling, modern propellants, and compliance with international treaties such as the Arms Trade Treaty remain major hurdles.

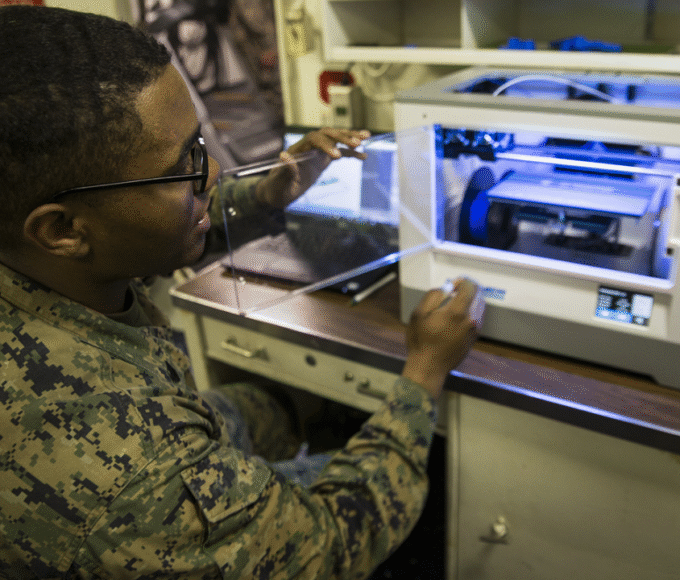

Innovation offers hope. Kenyan workshops are experimenting with 3D-printed prototypes, while South African plants are integrating AI-based quality assurance. Joint ventures like Brazil’s Taurus assembling firearms for Ghanaian forces enable technology transfer without sacrificing full control, balancing sovereignty with skill acquisition.

ECONOMICS AND RISK

According to the African Development Bank, local production can slash costs by up to 40% compared with imports. It also stimulates industrial supply chains from metallurgy to electronics and creates jobs in regions where unemployment fuels instability.

But increased production carries risks. Poor oversight could flood black markets with illicit weapons, worsening conflicts in places like the Democratic Republic of Congo or Somalia. Analysts warn that robust governance, transparent end-user certification, and African Union monitoring will be crucial to prevent misuse.

SHIFTING GEOPOLITICS

The push for local arms manufacturing is also geopolitical. By producing their own weapons, African nations reduce dependence on powers that often link military aid to political influence. It’s a direct challenge to neo-colonial dynamics, such as Russia’s Wagner Group operations or China’s defence-linked Belt and Road investments.

Regional cooperation is key. Within the BRICS framework, South Africa and Egypt have lobbied for joint technology-sharing pacts. The AU’s Silencing the Guns initiative, targeting 2030 for major reductions in arms imports, envisions a continental defence fund to finance indigenous production.

TOWARD SECURITY AND SOVEREIGNTY

The success of “Made-in-Africa” arms will depend on sustained investment, innovation, and cross-border collaboration. Rwanda’s emerging drone-and-ammunition industry hints at what’s possible: a new generation of African states turning defense manufacturing into a pillar of economic growth and strategic autonomy.

If realized, this transformation could redefine Africa’s role in global security—not as a consumer of other nations’ weapons, but as a producer shaping its own destiny.

King Richard Igimoh, Group Editor ALO

King Richard Igimoh, Group Editor African Leadership Organisation is an award-winning journalist, editor, and publisher with over two decades of expertise in political, defence, and international affairs reporting. As Group Editor of the African Leadership Organisation—publishers of African Leadership Magazine, African Defence & Security Magazine, and Africa Projects Magazine—he delivers incisive coverage that amplifies Africa’s voice in global security, policy, and leadership discourse. He provides frontline editorial coverage of high-profile international events, including the ALM Persons of the Year, the African Summit, and the African Business and Leadership Awards (ABLA) in London, as well as the International Forum for African and Caribbean Leadership (IFAL) in New York City during the United Nations General Assembly.

Recent Posts

Categories

- Air & Aerospace16

- Border Security15

- Civil Security4

- Civil Wars4

- Crisis5

- Cyber Security8

- Defense18

- Diplomacy19

- Entrepreneurship1

- Events5

- Global Security Watch6

- Industry8

- Land & Army8

- Leadership & Training5

- Military Aviation5

- Military History27

- Military Speeches1

- More1

- Naval & Maritime9

- Resources2

- Security12

- Special Forces1

- Systems And Technology9

- Tech6

- Uncategorized3

- UNSC1

- Veterans6

- Women in Defence9

Related Articles

AFRICA’S BLUE ECONOMY: UNLOCKING A WAVE OF SUSTAINABLE GROWTH

Africa’s blue economy represents one of the continent’s most promising frontiers for...

ByKing Richard Igimoh, Group Editor ALOOctober 3, 2025SYSTEMS & TECHNOLOGY – 3D PRINTING AND AFRICA’S DEFENCE INDUSTRY REVOLUTION

In modern warfare, where speed and adaptability can determine survival, 3D printing...

ByKing Richard Igimoh, Group Editor ALOOctober 1, 2025Sudan’s Mining Revival Begins with Russia, Putting African Resource Control in Focus

Sudan is betting on rocks—and maps—to rebuild its economy. The country has...

Byadmag_adminMay 31, 2025AFRICA’S CYBERSECURITY LANDSCAPE: FOCUS ON TANZANIA

Africa’s cybersecurity landscape is rapidly evolving, driven by the increasing adoption of...

Byadmag_adminMay 31, 2025